Finance & Business

Author: anonymDate: 2024-11-21 10:46:14

Woolworths commits significant capital as the ascendant rival, Amazon, expands into overlapping product categories.

Woolworths has invested hundreds of millions of dollars to compete with Amazon

The grocery behemoth, Woolworths, has alerted Australia's consumer protection agency to its apprehension regarding Amazon's burgeoning market presence. Global retail giants such as Aldi, Costco, and Amazon were cited amongst Woolworths' principal competitors during the Australian Competition and Consumer Commission (ACCC) supermarket investigation. Woolworths' chief executive, Amanda Bardwell, characterized Amazon as a formidable emerging competitor during the inquiry, despite Amazon's current non-involvement in the fresh produce segment (fruits, vegetables, meat, poultry, fish, and dairy).

Ms. Bardwell stated, "It now encompasses a growing assortment of our products...and accounts for approximately 40 percent of our overall product coverage."

Woolies looks to the web

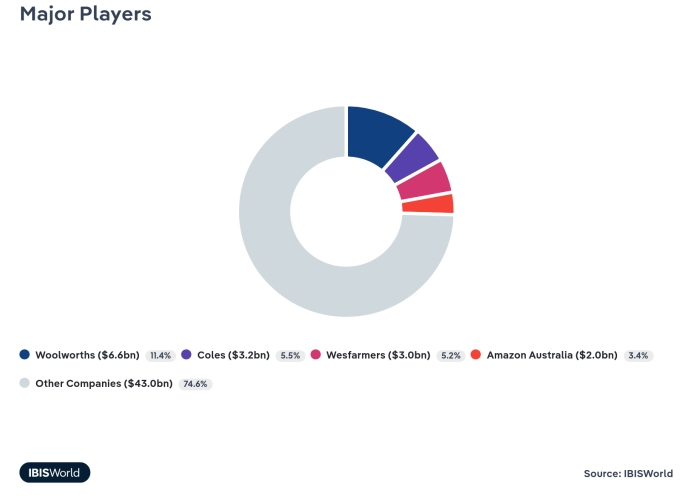

An October IBISWorld report designates Woolworths as the dominant player in Australian online retail, possessing over 11 percent market share and generating $6.6 billion in industry revenue. Amazon Australia was also classified as a "major player" in the report, with $2 billion in industry revenue and a 3.4 percent market share.

The supermarket inquiry revealed that online sales comprise about 15 percent of Woolworths' revenue, representing its most rapidly expanding segment. Ms. Bardwell remarked, "We anticipate a considerable upswing in the years ahead."

Amazon's Australian imprint

She informed the inquiry that Woolworths lacks precise data on Amazon's market share acquisition but that approximately 80 percent of the Australian populace resides within a twelve-hour radius of Amazon's Western Sydney distribution hub. The inquiry heard that Woolworths has invested hundreds of millions of dollars in its online capabilities to maintain competitiveness. Ms. Bardwell informed the inquiry, "As Amazon has globally illustrated, their expansion is markedly swift."

Shoppers in search for savings

Amazon launched its Australian online store in 2017 and is investing billions in its Australian operations. It operates six fulfillment centers and twelve logistics sites in Australia and is investing $1.6 billion in five additional operational sites, scheduled to open by 2026. In a submission to a separate ACCC inquiry concerning online platforms, Amazon claimed to represent a "minuscule fraction" of Australia's online sales—less than 2.5 percent in 2021–22. The submission added, "Consumers have an extensive array of retailers from which to choose, rendering retail an intensely competitive, expansive, and dynamic sector."

Professor Gary Mortimer of QUT's business school noted that Amazon's influence in Australia significantly lags behind other global markets but is steadily expanding. "Product categories like shelf-stable goods—cereals, soaps, detergents—represent a burgeoning market segment for them in Australia," he observed. He added that Australian consumers are actively seeking more affordable food and groceries. "A decade's worth of Roy Morgan data clearly indicates that well over 70 percent of us patronize two or three different retailers for food and groceries within a given two-week period," Professor Mortimer stated.

Shoppers still prefer in-store, watchdog says

In an official statement, Amazon emphasized that online retailers are providing relief to Australians grappling with household budget constraints. Amazon also asserted its commitment to providing value to Australian customers and empowering Australian small businesses to utilize its platform. "Research suggests that without the cost efficiencies and competitive pressures of online retail channels, annual inflation would have been 0.7 percentage points higher at its peak in 2022," the statement read.

In its interim report on the supermarket inquiry, the ACCC indicated that Coles, Woolworths, and the Australian Retailers Association were the sole entities to identify Amazon as a potentially substantial competitor in their submissions. The report stated, "ACCC consumer survey data suggests that most Australian consumers presently favor in-store grocery shopping." Five percent of ACCC survey participants reported regularly purchasing groceries from Amazon, while 17 percent reported occasional purchases. Seventy-eight percent reported never purchasing groceries from Amazon.

Fresh food key to supermarket status

Mildura resident Selwyn Patterson told the ABC that he prefers in-store grocery shopping. "When purchasing groceries or fresh food, I opt for locations where I can visually inspect the merchandise and make informed selections, rather than relying on unseen delivery," he explained. He conceded, however, that price and convenience might induce him to consider online shopping.

In his June review of Australia's Food and Grocery Code of Conduct, Dr. Craig Emerson concluded that Amazon does not currently operate as a "supermarket business," due to its lack of fresh produce offerings.

During the supermarket inquiry, the ACCC's barrister, Naomi Sharp SC, questioned whether Woolworths anticipated Amazon replicating its product range or market presence within the next ten years. Mr. Bardwell responded, "Providing the fresh and cold chain management we utilize for certain fresh product categories requires substantial investment."